Q4 North Texas Leasing Reality Check: The Numbers I’m Seeing (and How We Lease Homes Faster at DWC Property Group)

If you own a rental in North Texas, Q4 wasn’t “business as usual.” Demand was still there, but it was more selective, more impatient, and a lot less forgiving when a home wasn’t priced and positioned correctly.

I’m Darrell Calhoun, owner of DWC Property Group, and I sat down and did a deep dive on Q4 leasing behavior using the same data lens we use to manage listings day to day. I’m writing this as a North Texas report, because the patterns map cleanly to what we see across our leasing footprint, including Celina, McKinney, Prosper, Allen, and Frisco.

And because people don’t live in “zip codes,” they live in neighborhoods, I’m going to talk about this like we actually talk about it in the field: Light Farms, Legacy Hills, Mustang Lakes, and the communities our renters mention by name every week.

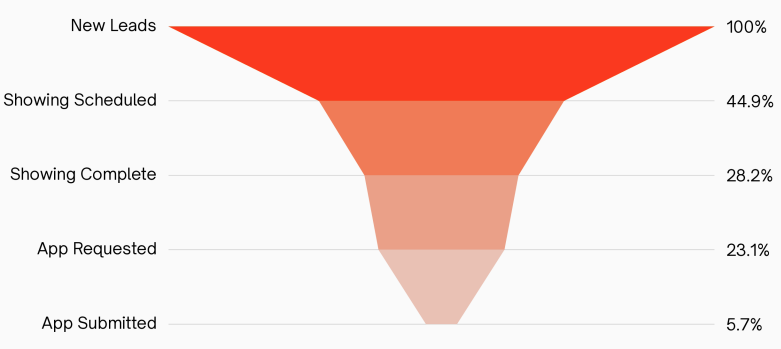

The North Texas leasing funnel is still brutal (so process wins)

Here’s the reality: a listing can get attention, but only a small slice becomes an application.

In my Q4 North Texas benchmark funnel, this is what I came up with:

Showing Scheduled: 44.9% of new leads

Showing Complete: 28.2% of new leads

Application Requested: 23.1% of new leads

Application Submitted: 5.7% of new leads

That means if you’re sitting on a rental in a high-demand lifestyle community like Light Farms in Celina (or newer build pockets near the tollway growth), you can still get inquiries… but your conversion depends on how tight your process is after the first message.

Where we win the funnel at DWC (and where most managers leak money)

The middle is where the money is:

Speed to response (minutes, not hours)

Frictionless scheduling (no back-and-forth)

A dead-simple next step to apply (no confusion, no delays)

This matters everywhere, but it’s especially true in communities where renters are moving for schools, commute convenience, and amenities, places like Legacy Hills (Celina) as it builds out, or family-heavy pockets in Prosper and Frisco with heavy relocation traffic.

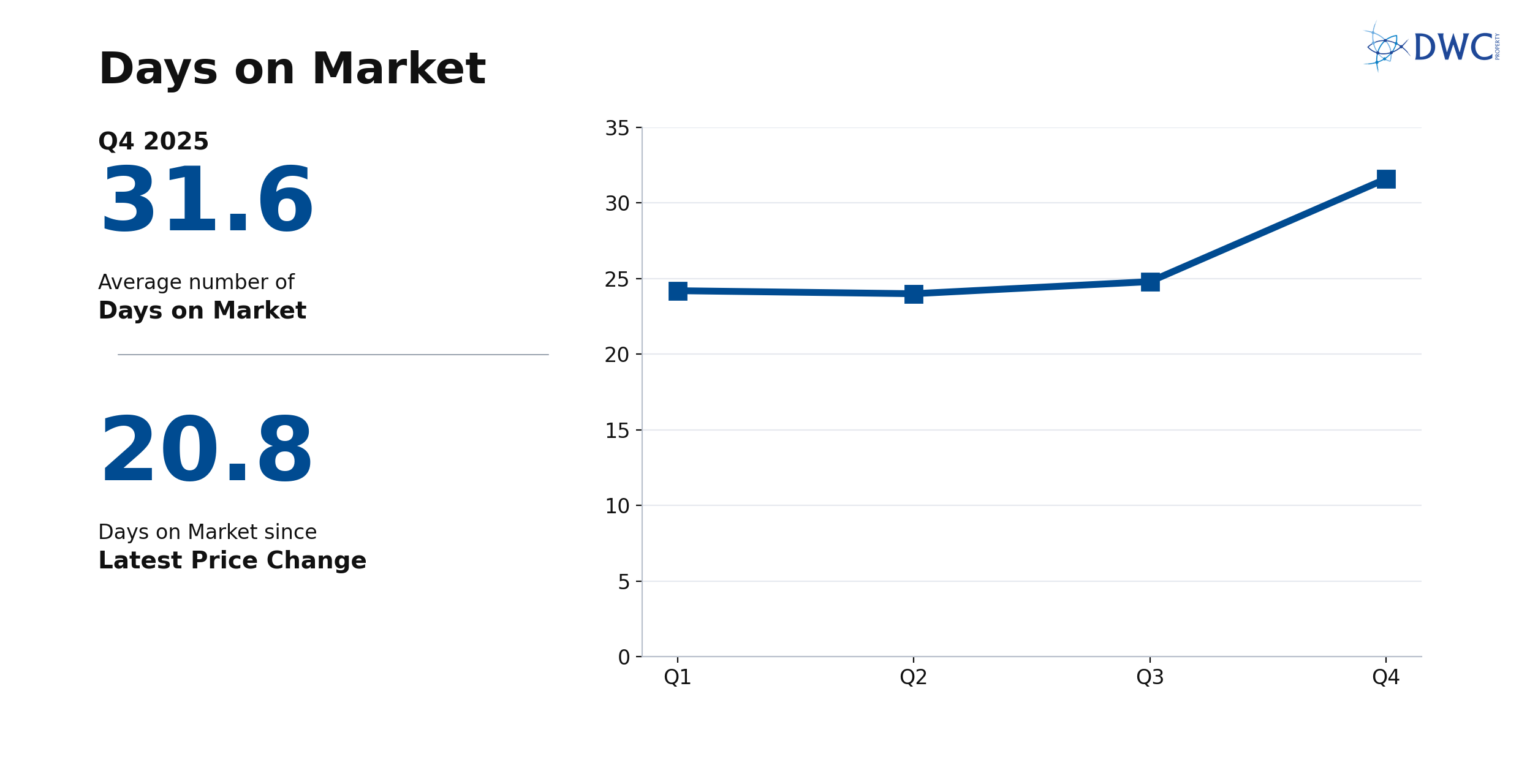

Days on market climbed, and the “price correction clock” is real in North Texas

My Q4 benchmark for North Texas average days on market was 31.6 days.

But the more telling stat was this:

20.8 days on market since the most recent price change

That number matters because it reveals what I call the price correction clock. When pricing is off, the market doesn’t punish you instantly, it drips the penalty out over weeks in the form of vacancy.

This is true whether you’re in McKinney near established master-plans like Stonebridge Ranch and Trinity Falls, or you’re in Frisco with newer, amenity-heavy neighborhoods like Phillips Creek Ranch pulling steady demand.

Pricing mistakes are costing owners more than they realize

This is the section I want owners in Celina and Prosper to read twice, because the temptation in those areas is to “start high” and assume the market will chase you.

In my Q4 analysis:

59.1% of properties needed at least one price reduction

Average number of reductions: 2.3

Average total reduction: about $99.37

Those aren’t freak events. That’s the market telling us many homes are starting overpriced relative to the demand that actually exists in that moment.

How we apply pricing at DWC

We don’t guess. We run a system:

We price to win the first 7–10 days, not “test the market.”

We pre-agree on a decision date (example: Day 10) to adjust if showing activity isn’t there.

We track what matters: showings completed and quality inquiries.

That’s how you avoid getting trapped in the “two price drops later” cycle.

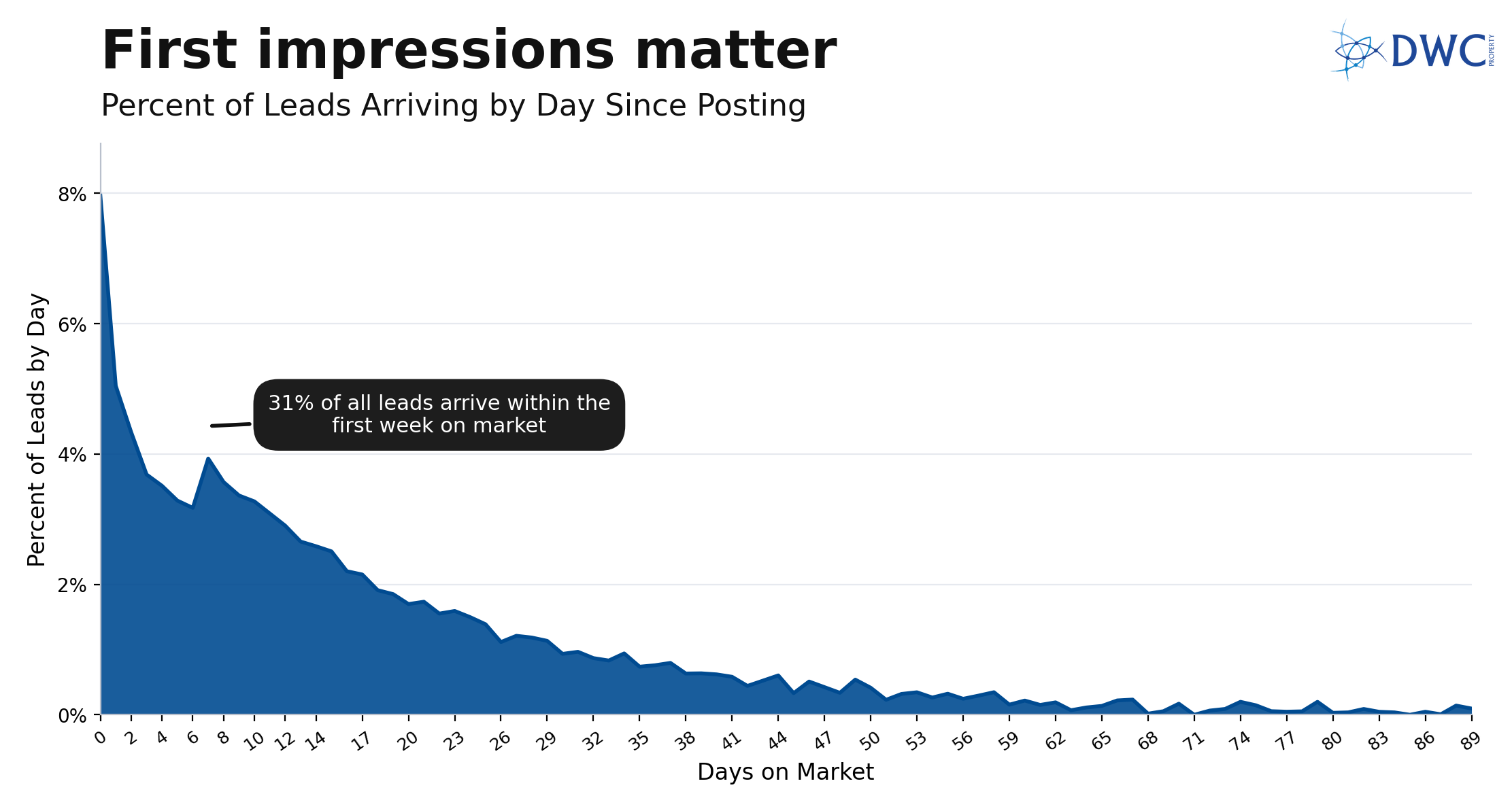

The first week is everything (especially in master-planned neighborhoods)

In Q4, 31% of leads arrived within the first week of a listing going live.

That first week is your best shot at capturing the renters who are serious, qualified, and ready to move. And in neighborhoods like Light Farms and Mustang Lakes (where renters are often targeting specific schools and lifestyle amenities), that early wave is the most valuable wave.

What a “strong launch” looks like for DWC

Professional photos that actually show brightness and space

A description that answers the big questions (pets, fees, move-in timeline)

Showing access ready Day 1

A response system that doesn’t wait for office hours

Renters are shopping after hours (and North Texas proves it)

In my Q4 benchmark, 52.5% of leads came in after business hours.

That’s not surprising if you’ve ever rented or relocated. People search after dinner. They tour on weekends. They decide quickly.

If your response is slow, you don’t just lose a lead. You lose the lead.

Speed-to-response is no longer optional (and systems beat “being busy”)

The Q4 response-time spread is wild:

Median “human” response time: 384.28 minutes

AI-assisted / automated response time: 6 seconds

Call it automation, systems, or just operational discipline. The point is the same: fast answers schedule more showings.

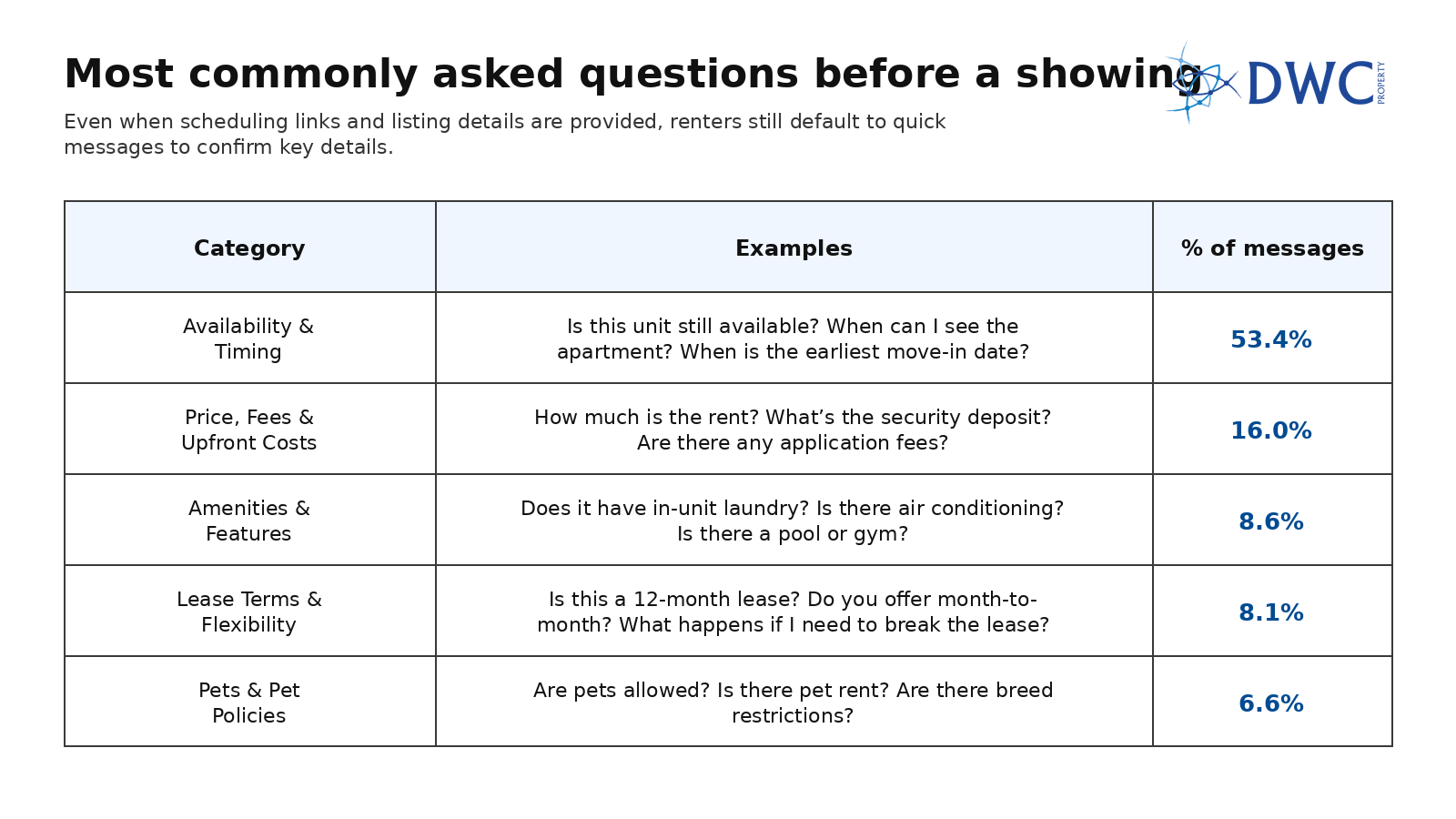

And renters ask the same questions over and over:

availability, move-in timing, fees, pets, lease terms, amenities.

If those answers aren’t immediate and clean, they keep shopping.

Self-guided showings outperform because they remove friction

Q4 also reinforced what we see weekly: self-guided tours beat accompanied showings on the metrics that matter, because renters can tour sooner and on their schedule.

Also important: long lead times kill momentum. If someone wants to tour tomorrow and you can’t accommodate them until next week, you didn’t lose a showing. You lost a renter.

This is one reason neighborhoods with high activity like Frisco’s master plans (and key relocation areas) can feel competitive even when the broader market slows.

Follow-up is where applications are won (or lost)

Here’s the number that should change how you operate:

Average time from showing to application submission: 2.21 days

That means your follow-up has to carry the renter from “We liked it” to “We applied” without letting them drift to another listing.

Where property managers leak money:

No structured follow-up sequence

Slow answers to simple questions

No clear call-to-action after the showing

At DWC, we treat follow-up like a sales pipeline, because that’s what it is.

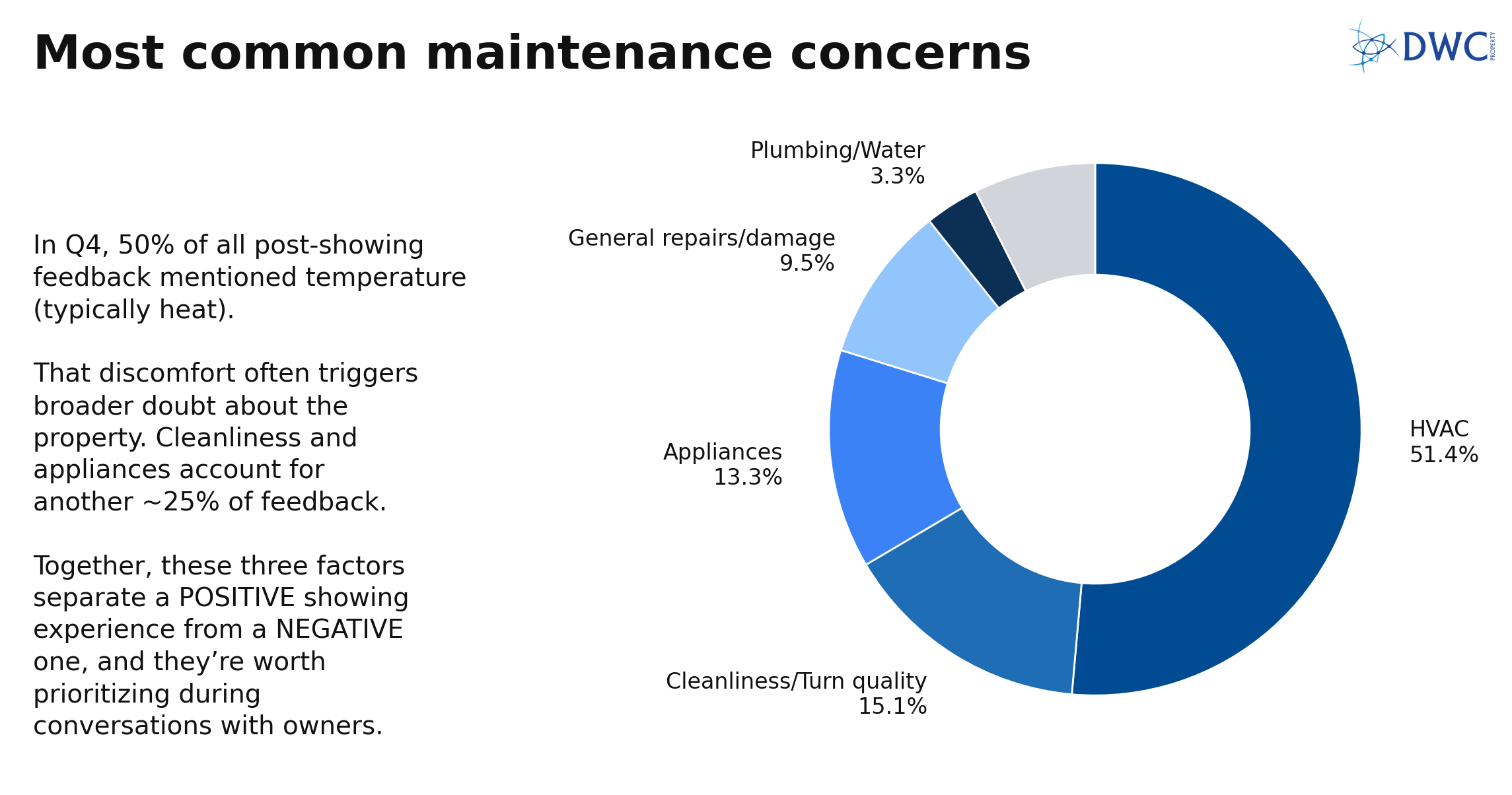

Showing feedback tells the truth (HVAC, appliances, and turn quality)

When pricing is right but applications aren’t coming in, showing feedback usually exposes the real problem.

The recurring themes in Q4 were:

HVAC and comfort issues

Appliances

Cleanliness and turn quality

Owners in communities like Legacy Hills (Celina) and established luxury pockets in Frisco already know this instinctively: renters can smell “deferred maintenance” instantly, even if they don’t call it that.

Neighborhood callouts people actually relate to

Here’s how these numbers play out in real neighborhoods renters talk about:

Celina

Light Farms: renters are often very intentional, they’re shopping schools and amenities, and they expect smooth scheduling and fast answers.

Legacy Hills: as it builds out, renters will compare condition and finish level heavily, and pricing has to match the reality of what’s available that week.

Mustang Lakes: strong demand, but a “strong demand neighborhood” still punishes slow response and messy showing logistics.

McKinney

Renters commonly target master-planned, lifestyle communities like Stonebridge Ranch, Trinity Falls, and Tucker Hill (and unique pockets like Adriatica Village). The common thread: they have options, and they’ll move on fast if your process is slow.

Prosper

Neighborhoods like Windsong Ranch, Star Trail, Artesia, and Whitley Place attract families and relocations. That means after-hours inquiries are common, and first-week execution matters.

Frisco

Places like Phillips Creek Ranch, Starwood, Newman Village, and The Trails draw renters who are comparison-shopping hard. If your home doesn’t show well or your response is slow, they have ten other tours queued up.

Allen

In neighborhoods like Twin Creeks and Watters Crossing, renters tend to move for stability, schools, and commute patterns. That means clean presentation and quick follow-up are the difference between “we’ll think about it” and “we applied.”

Recent DWC lease in Light Farms (Celina): how the numbers played out

We just wrapped up a lease in Light Farms that’s a perfect real-world example of what these Q4 North Texas leasing numbers look like when you execute the process correctly.

Property snapshot

Neighborhood: Light Farms, Celina

Home: 4 bed / 2 bath

Listed: January 16

Activity: 11 showings

Application received: January 19

Approved: January 21

Move-in: February 1

Lease rate: $3,400/month

How this ties directly to the North Texas Q4 benchmarks

Speed wins in Week 1: One of the biggest takeaways from the Q4 numbers is that demand hits early (a huge portion of leads show up in the first week). In Light Farms, we treated launch week like a deadline and pushed hard for immediate showing availability and quick responses.

Showings create the pressure: The funnel tells you most leads won’t convert, so the goal is to move qualified prospects to tours fast. We generated 11 showings in just a few days, which created urgency and helped us avoid the “stale listing” problem.

The 2-day application window is real: Q4 data shows applications commonly land about 2.21 days after a showing. Here, we received an application on January 19, just three days after listing, because we kept the process clean, fast, and frictionless.

Follow-up closes the deal: A lot of managers lose deals in the gap between tour and application. We followed up quickly, answered the key questions immediately, and guided the prospect to the finish line — approved January 21.

Outcome: From list date (Jan 16) to approval (Jan 21) was 5 days, with a Feb 1 move-in at $3,400 in one of Celina’s most in-demand lifestyle neighborhoods.

The DWC Property Group leasing promise

We can’t control seasonality. We can control execution.

Here’s what we focus on for every listing:

Pricing strategy with a decision timeline

Strong launch presentation

Rapid lead response and clear answers

Fast, convenient showing scheduling

Structured follow-up that closes

See our full list of guarantees here: DWC Guarantees!

Calculate Your Rent, ROI, and Vacancy Risk Before You Lease

Want us to run this playbook on your rental?

If you own a rental in Celina, McKinney, Prosper, Allen, or Frisco and you want a leasing plan built on real Q4 behavior, reach out to DWC Property Group. We’ll show you exactly how we’d price, position, and market your home to lease quickly without cutting corners.

Before you reach out, you can also get a head start here:

Neighborhood leasing analysis: Free Rental Analysis

Rent vs. Sell Calculator: Free Rent Vs. Sell Evaluation

Return on Investment Calculator: Free Return on Investment Evaluation

Vacancy Cost Calculator: How much does it cost me for my house to sit vacant?

If you want this to feel even more personal, tell me the exact neighborhood you’re in (Light Farms, Legacy Hills, Mustang Lakes, Stonebridge Ranch, Windsong Ranch, Phillips Creek Ranch, etc.). I’ll tailor the intro, the case study, and the close to your specific area. Email me anytime at dcalhoun@dwcproperty.com

_2.png)